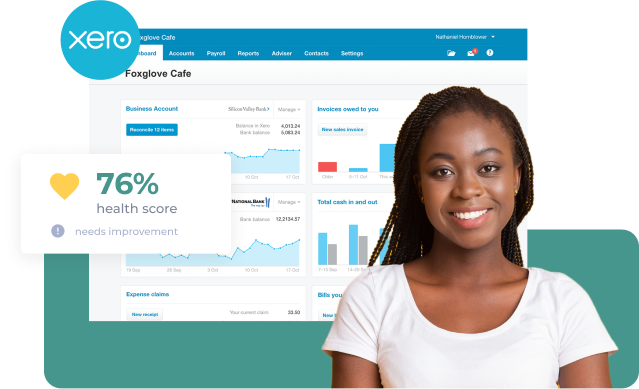

Xero Health check

Our Xero specialists are trained to look for errors and inconsistences, and recommend ways to improve the function of your Xero file.

Ensure accurate bookkeeping with professional analysis

What is a Health check?

Our Xero specialists are trained to look for errors and inconsistences, and recommend ways to improve the function of your Xero file. Health Check involves conducting an analysis of your Xero account setup.

What will be checked?

- Xero setup settings

- Payroll settings and setup

- Bank balance inaccuracies

- Unreconciled transactions

- Sales invoicing review

- VAT coding mistakes

- Manual journals

- Reports

- and much more

How are the result presented?

We will email you detailed overview of the findings alongside with a health score. You’ll also get a 20 minute call with one of our team members to run through the audit. Should you require any help with resolving the issues found or ongoing advice and training, we are here to help you, as needed.

How often should you get it done?

To get the most benefit from a Health Check, like any health check, they are best scheduled regularly as a shorter timeframe allows you to catch problems as they arise. If your business is in a growth phase or is highly transactional, we recommend timing your Health Check with your VAT lodgements: every two months!

For smaller businesses with lower transaction volume or businesses that are experiencing stable growth periods, you could carry out checks every 6-12 months.

Late payers follow-up

It may be intimidating for you to remind the client you have such a great working relationship with about an invoice that is overdue for payment. To avoid the stress, we help you to get paid faster. Firstly, we will make sure that easy payment options are enables to your invoices. Then send automated reminders, and if nothing else works we will follow up with a phone call, which we always keep friendly and professional.

Supplier Bills and Payments

We will make it easy for you to manage receipts and bills. All we need from you is to snap a photo of your on-the-go expenses, the rest will be handled by us. We will send you reminders of the bills coming due and schedule payments to help with bill-smoothing and cashflow.

Bank reconciliation

We know, even the name sounds boring. Don’t worry, this is the essential part that we will do to keep your financial records up to date, so you can focus on the fun side of running a business and casually check in to see where your business really stands.

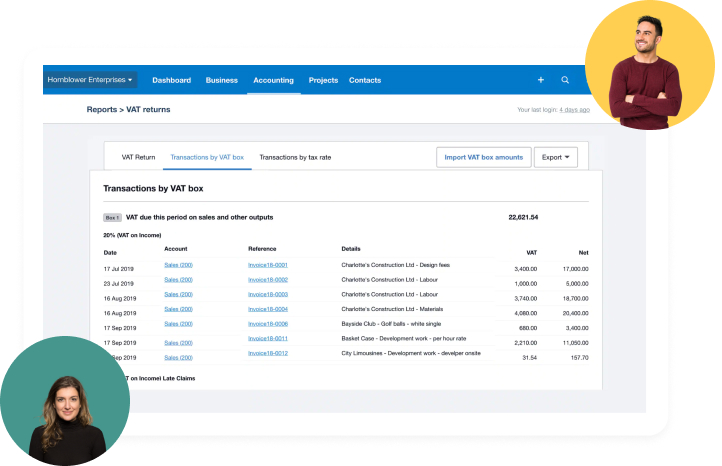

VAT return

You probably know well when and how much VAT to charge on your sales. But with all your overseas subscriptions, EU, non-EU orders it may get complicated to stay of top of all VAT credits you can use to offset your VAT bill. We will make sure no expense gets missed and file the bi-monthly VAT returns for you.

Frequently asked questions

Once you have given your current bookkeepers the required notice, agree on a date when they should have all the bookkeeping done up to so there isn’t any double up work done. After that, we will get in touch with them to get the accounting file and subscription handed over.

Yep! No matter how far behind you are, we can get you caught up quickly.