How it works

At our initial catch-up, we will learn more about your business and provide a walkthrough of our services. We can be as hands-on with your monthly bookkeeping as you need us to, or simply assist with more complex number crunching while you manage day-to-day. Your monthly bookkeeping service fee will be built based on that. If you are not quite sure what tasks to keep and what to delegate, let us prepare a comparative pricing so you can put an euro value to see if it is worth your time.

We may need few numbers from you, such as how many sales invoices you issue per month or how often do you pay your employees. Alternatively, you can share us the access to your current accounting solution and we can extract all the details from there.

Late payers follow-up

It may be intimidating for you to remind the client you have such a great working relationship with about an invoice that is overdue for payment. To avoid the stress, we help you to get paid faster. Firstly, we will make sure that easy payment options are enables to your invoices. Then send automated reminders, and if nothing else works we will follow up with a phone call, which we always keep friendly and professional.

Supplier Bills and Payments

We will make it easy for you to manage receipts and bills. All we need from you is to snap a photo of your on-the-go expenses, the rest will be handled by us. We will send you reminders of the bills coming due and schedule payments to help with bill-smoothing and cashflow.

Bank reconciliation

We know, even the name sounds boring. Don’t worry, this is the essential part that we will do to keep your financial records up to date, so you can focus on the fun side of running a business and casually check in to see where your business really stands.

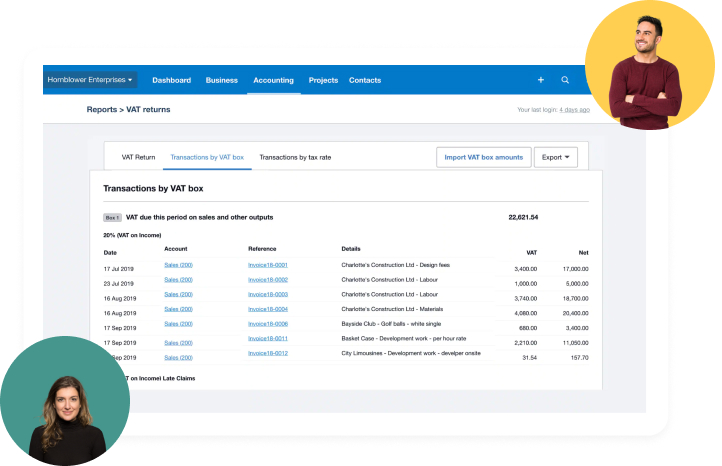

VAT return

You probably know well when and how much VAT to charge on your sales. But with all your overseas subscriptions, EU, non-EU orders it may get complicated to stay of top of all VAT credits you can use to offset your VAT bill. We will make sure no expense gets missed and file the bi-monthly VAT returns for you.

Bookkeeping just got more affordable

Unlimited referrals

Refer a fellow entrepreneur and receive a free month of bookkeeping for every referral who becomes a Krunchr client.

Tax deductible

Krunchr is fully tax deductible when our favourite time of year rolls around.

Frequently asked questions

After you sign up with Krunch, we’ll pair you with a dedicated bookkeeper.

Your bookkeeper reconciles your accounts, categorises your transactions, prepared bills for payment, helps with invoicing, processes payroll and produces your financial statements. They also make adjustments to your books to ensure they’re accurate and tax-compliant. Occasionally your bookkeeper might need your input on things like receipts that didn’t get a photo taken or a payment approval, but we try our best to make bookkeeping as hands-off as possible for you.

You can also book a call with your bookkeeper (or send them a message) whenever you’d like. There’s no extra fee or hourly charges for support—we’re always happy to nerd out about bookkeeping and your financial statements.

Once we receive all of your documents, we’ll complete your bookkeeping for the month within 15 business days. This gives us enough time to make any necessary adjustments before the end of the month.

We are completely paperless bookkeeping office and will have the best toolkit in place to get documents from you. All you need to do is to give us access to your dedicated accounts email address. If you don’t have, we will assist you to set one up, as it is a major time saver for business owners. For all the on-the-go expenses and payments you made on your card, you will simply take a photo of with an app which we will setup for you.

Bookkeeping is the process of recording daily transactions in a consistent way, and is a key component to building a financially successful business. Bookkeepers take care of the day-to-day financials, like posting credits and debits, maintaining the general ledger, and completing payroll.

Accounting is a high-level process that uses financial information compiled by a bookkeeper or business owner, and produces financial models using that information. Some accountants do bookkeeping also, especially at year-end when their client’s haven’t gotten around to do it or when incorrectly categorised transactions need to be fixed. Quite often, accounting fees are significantly higher, so it may be more cost-effective to get a bookkeeper to review your bookkeeping before it gets sent to the accountant for filing.