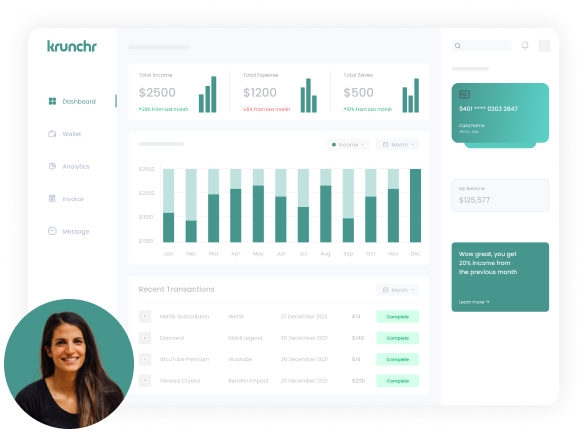

Monthly bookkeeping

Did you know that small businesses spend 120 working-days per year on administration?

The days of do-it-yourself bookkeeping are over. Krunchr does it for you—so you can focus on running your business.

Simplify your finances with our expert bookkeeping services

Whether you sell enterprise software, handmade candles or legal advice, there are two things we can guarantee about your business: you earn money and you spend it. Our bookkeepers can help you to keep track of all that. We will set you up with the best technology to run hands free, so that your books are tax compliant and always up to date.

Sales Invoicing

We help to create customer invoices, record incoming payments or identify and follow-up on past due receivables. If you already have a Point-of-Sale system set-up that allows you to record all sales transactions and take payments, we’ll make sure this information is sent through to your accounting system on a timely basis.

Late payers follow-up

It may be intimidating for you to remind the client you have such a great working relationship with about an invoice that is overdue for payment. To avoid the stress, we help you to get paid faster. Firstly, we will make sure that easy payment options are enables to your invoices. Then send automated reminders, and if nothing else works we will follow up with a phone call, which we always keep friendly and professional.

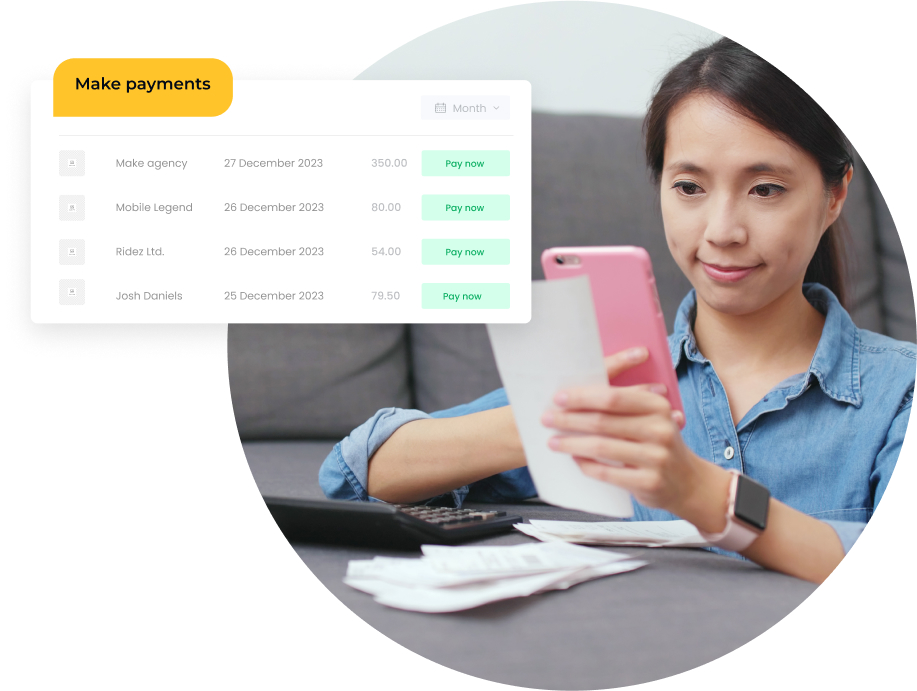

Supplier Bills and Payments

We will make it easy for you to manage receipts and bills. All we need from you is to snap a photo of your on-the-go expenses, the rest will be handled by us. We will send you reminders of the bills coming due and schedule payments to help with bill-smoothing and cashflow.

Bank reconciliation

We know, even the name sounds boring. Don’t worry, this is the essential part that we will do to keep your financial records up to date, so you can focus on the fun side of running a business and casually check in to see where your business really stands.

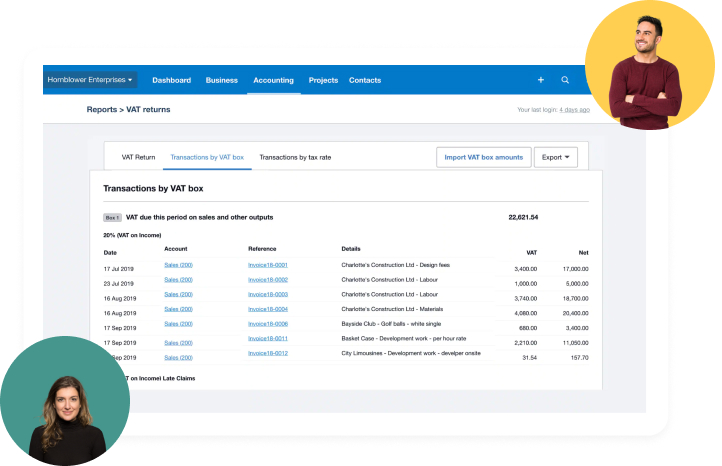

VAT return

You probably know well when and how much VAT to charge on your sales. But with all your overseas subscriptions, EU, non-EU orders it may get complicated to stay of top of all VAT credits you can use to offset your VAT bill. We will make sure no expense gets missed and file the bi-monthly VAT returns for you.

Frequently asked questions

After you sign up with Krunch, we’ll pair you with a dedicated bookkeeper.

Your bookkeeper reconciles your accounts, categorises your transactions, prepared bills for payment, helps with invoicing, processes payroll and produces your financial statements. They also make adjustments to your books to ensure they’re accurate and tax-compliant. Occasionally your bookkeeper might need your input on things like receipts that didn’t get a photo taken or a payment approval, but we try our best to make bookkeeping as hands-off as possible for you.

You can also book a call with your bookkeeper (or send them a message) whenever you’d like. There’s no extra fee or hourly charges for support—we’re always happy to nerd out about bookkeeping and your financial statements.

Once we receive all of your documents, we’ll complete your bookkeeping for the month within 15 business days. This gives us enough time to make any necessary adjustments before the end of the month.

We are completely paperless bookkeeping office and will have the best toolkit in place to get documents from you. All you need to do is to give us access to your dedicated accounts email address. If you don’t have it, we will assist you to set one up, as it is a major time saver for business owners. For all the on-the-go expenses and payments you made on your card, you will simply take a photo of with an app which we will setup for you.