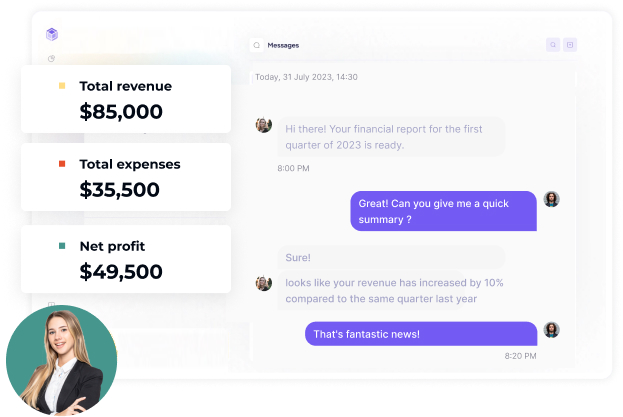

Easy-to understand financial reporting

We will send you a snapshot every month to see what your money is up to.

Clear and concise financial reporting for your business

Our comprehensive financial reporting service ensures that you have a clear understanding of your business’s financial health. With easy-to-read reports, you can make informed decisions and track your progress towards your financial goals. Our expert team is always available to help you interpret the data and provide insights for your business.

Late payers follow-up

It may be intimidating for you to remind the client you have such a great working relationship with about an invoice that is overdue for payment. To avoid the stress, we help you to get paid faster. Firstly, we will make sure that easy payment options are enables to your invoices. Then send automated reminders, and if nothing else works we will follow up with a phone call, which we always keep friendly and professional.

Supplier Bills and Payments

We will make it easy for you to manage receipts and bills. All we need from you is to snap a photo of your on-the-go expenses, the rest will be handled by us. We will send you reminders of the bills coming due and schedule payments to help with bill-smoothing and cashflow.

Bank reconciliation

We know, even the name sounds boring. Don’t worry, this is the essential part that we will do to keep your financial records up to date, so you can focus on the fun side of running a business and casually check in to see where your business really stands.

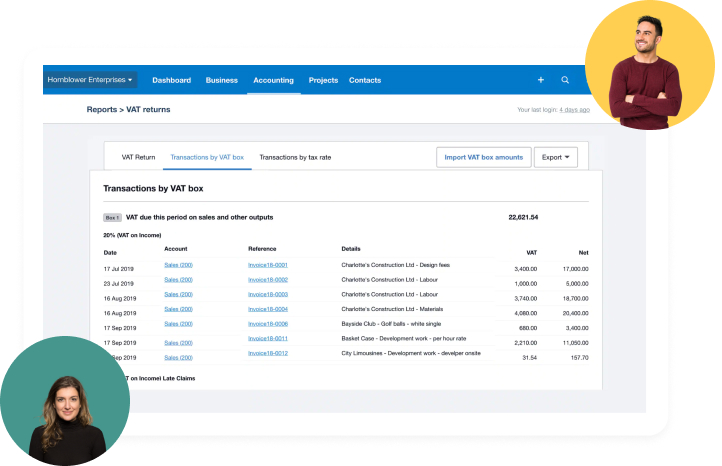

VAT return

You probably know well when and how much VAT to charge on your sales. But with all your overseas subscriptions, EU, non-EU orders it may get complicated to stay of top of all VAT credits you can use to offset your VAT bill. We will make sure no expense gets missed and file the bi-monthly VAT returns for you.

Stay on top of your money

Not sure if you’re turning a profit? Your monthly income statement tells you how much money is entering and leaving your business

See the big picture

Need a snapshot of your business? Your balance sheet shows the total value and financial health of your company, all in one place.

Accurate, tax-ready financials

Filing on your own? Working with a Tax Accountant? Either way, we’ve got your back. We send tidy tax time financials, so you can get filed fast. We’ll even work directly with your accountant.

Frequently asked questions

Bookkeeping is the process of recording daily transactions in a consistent way, and is a key component to building a financially successful business. Bookkeepers take care of the day-to-day financials, like posting credits and debits, maintaining the general ledger, and completing payroll.

Accounting is a high-level process that uses financial information compiled by a bookkeeper or business owner, and produces financial models using that information. Some accountants do bookkeeping also, especially at year-end when their client’s haven’t gotten around to do it or when incorrectly categorised transactions need to be fixed. Quite often, accounting fees are significantly higher, so it may be more cost-effective to get a bookkeeper to review your bookkeeping before it gets sent to the accountant for filing.

We will make sure your Tax Accountants have access to the accounting system at all times and when it is time to prepare the Tax returns, we will work with them hand-in-hand to get the financials filed fast.